Introduction

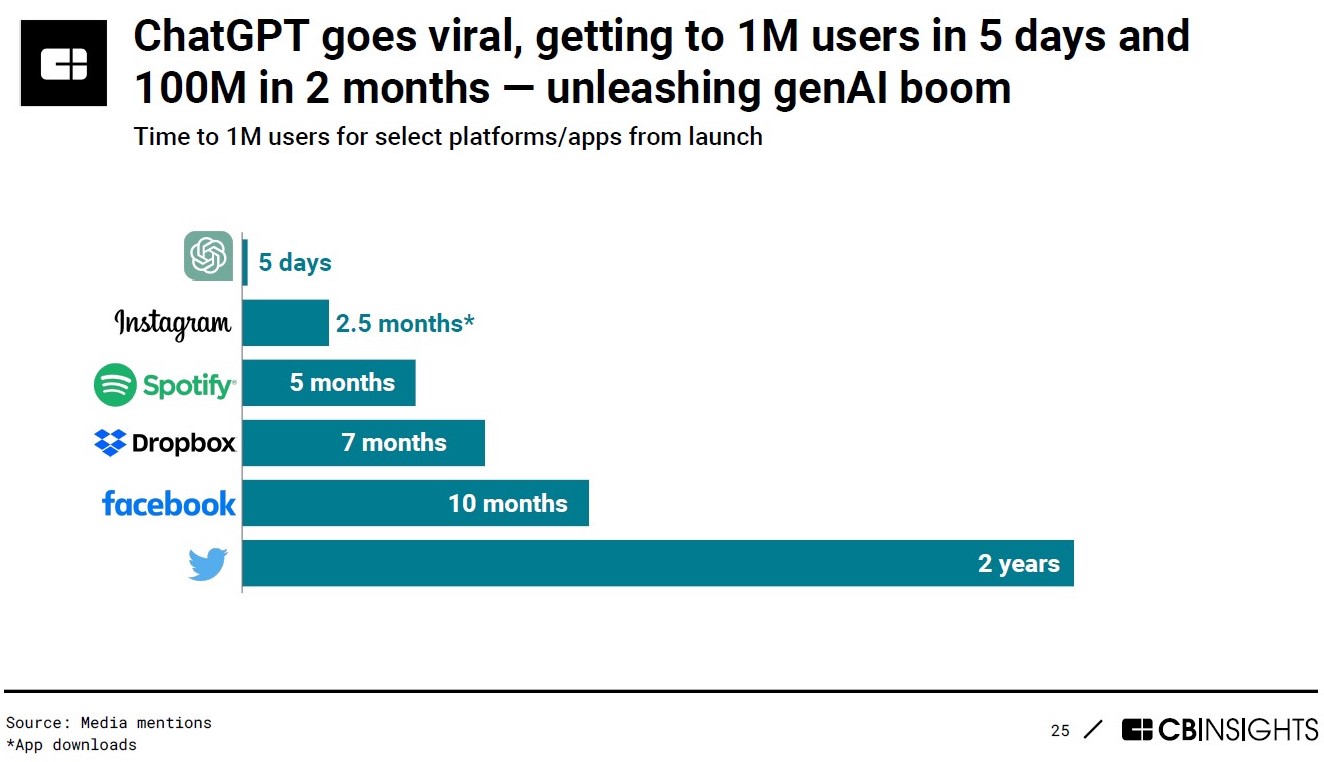

We have a new boom in tech: Generative Artificial Intelligence, or GenAI. It is a game-changer for entrepreneurs, exits and valuations. GenAI is blowing away all the pessimism clouding the tech industry today. Its rate of adoption is faster than any new technology preceding it.

Figure 1 shows that ChatGPT, the first and largest GenAI application, reached 1 million users in 5 days.

Figure 1. Unleashing the GenAI Boom.

We could add the previous record holder, the Android operating system, to the table which gained 1 million users in 3 months. ChatGPT blew it away as well.

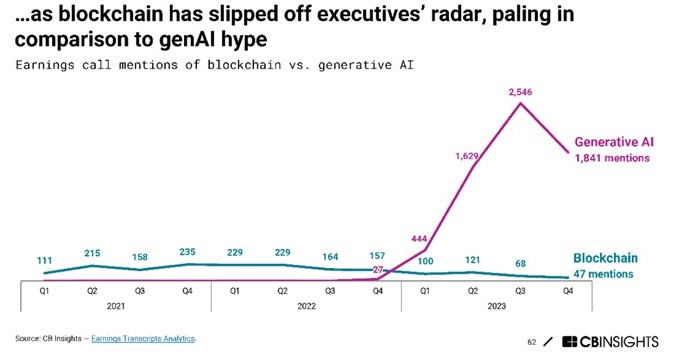

The new promise of GenAI is entering mainstream vernacular. Figure 2 shows that GenAI is taking over the conversation.

Figure 2. GenAI Quickly Gathers Momentum.

Microsoft said that the Chatbot GPT was as important as the PC and the Internet, a remarkable statement from one of the Magnificent 7.

We are seeing GenAI dominating funding, partnerships, and the focus on development in the tech sector, which is expected. As we will discuss below GenAI is also spreading throughout many non-tech industries.

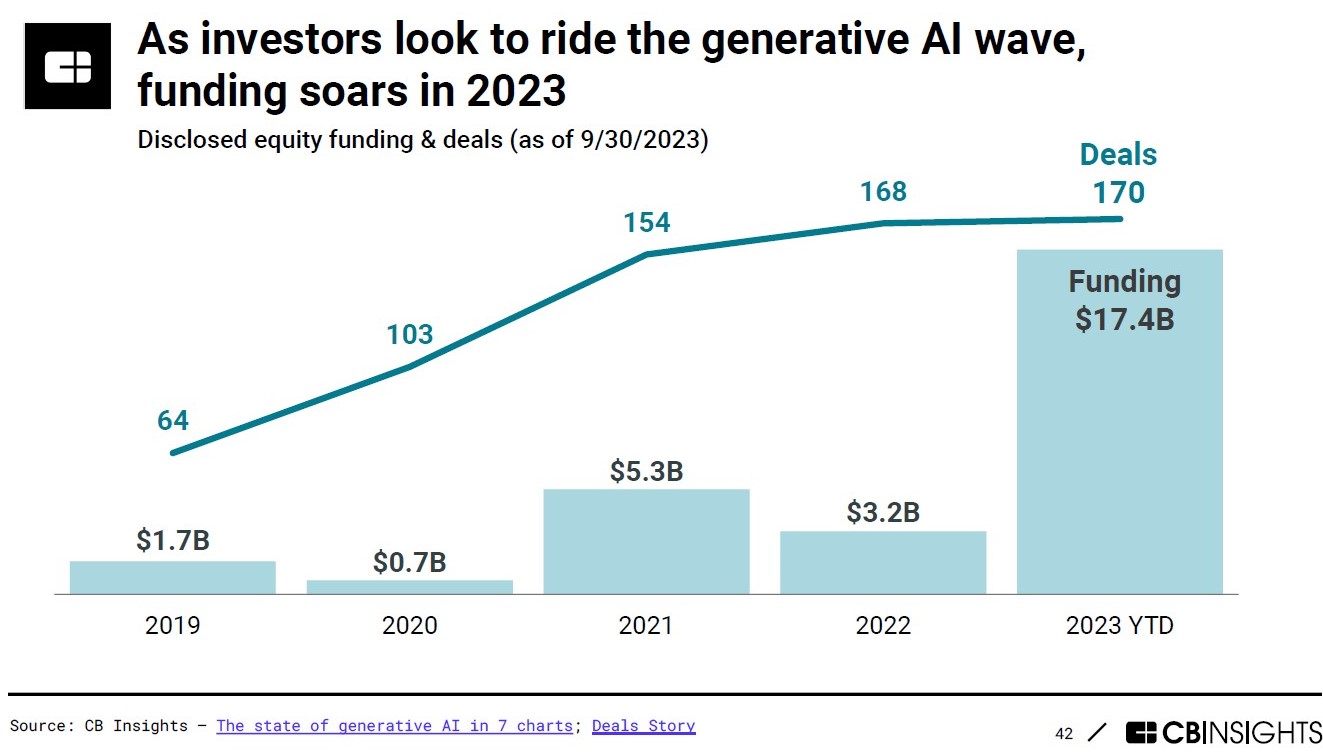

Funding for GenAI from the Usual Sources

The arrival of GenAI caused an explosion in funding for the new technology among the usual cohort of Venture Capital companies and industry players. Figure 3 shows a massive jump in funding for GenAI in 2023.

Figure 3. Explosion in GenAI Funding in 2023.

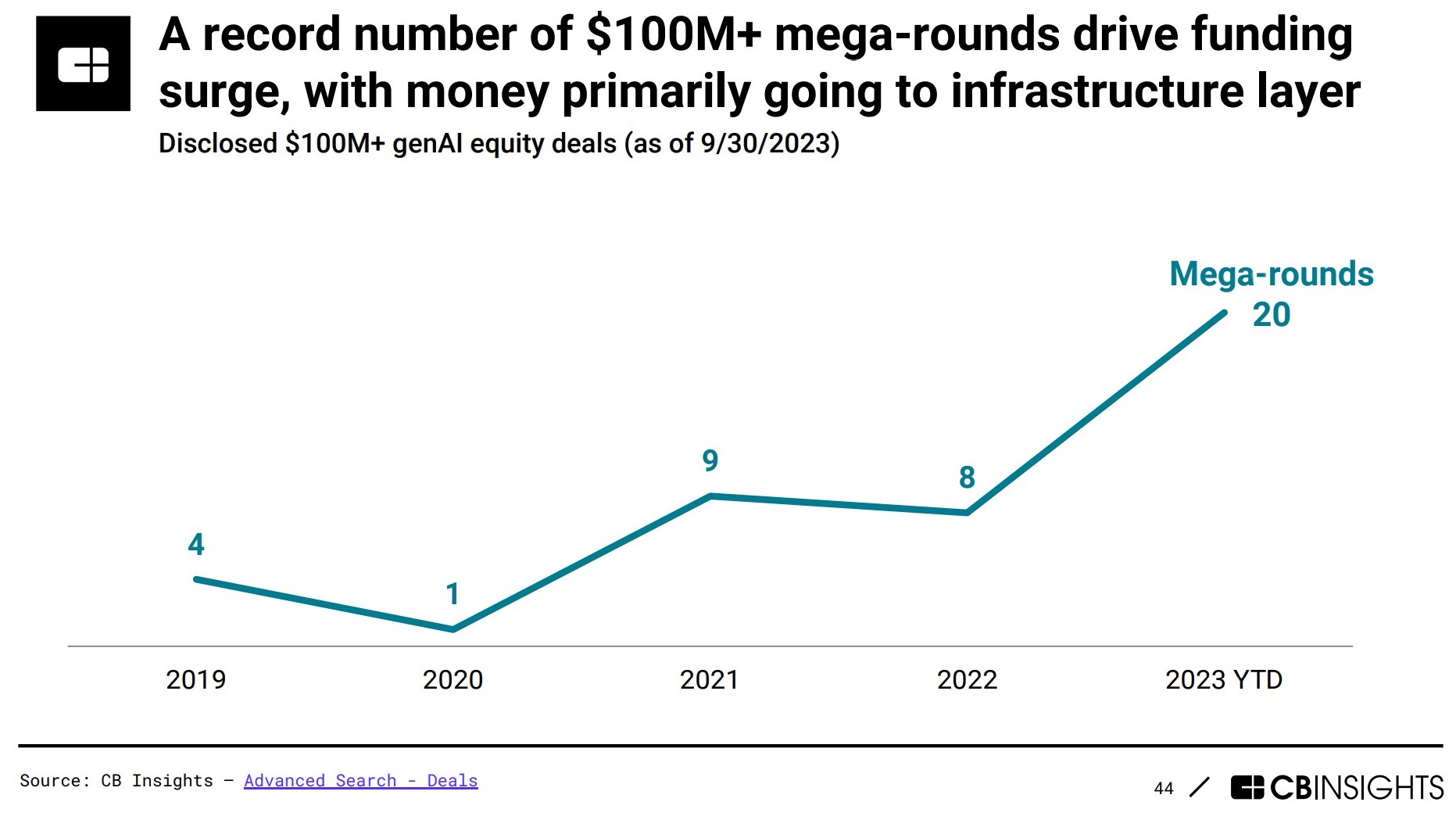

Hundreds of investments have been made recently, many exceeding $100M, as shown in Figure 4.

Figure 4. Record Number of $100M Mega-rounds.

Microsoft’s $10 Billion investment in 2023 in OpenAI, the inventor of ChatGPT, confirmed that GenAI was the next big thing in technology.

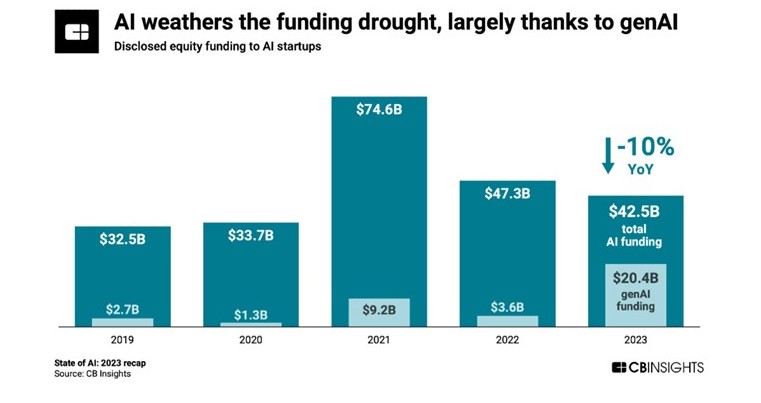

It is notable that most of the investment in 2023 in AI targeted GenAI while DAI struggled. Investment in the Discriminative AI industry declined from 2021 through 2023, as shown in Figure 5.

Figure 5. GenAI Carried Investment in AI in 2023.

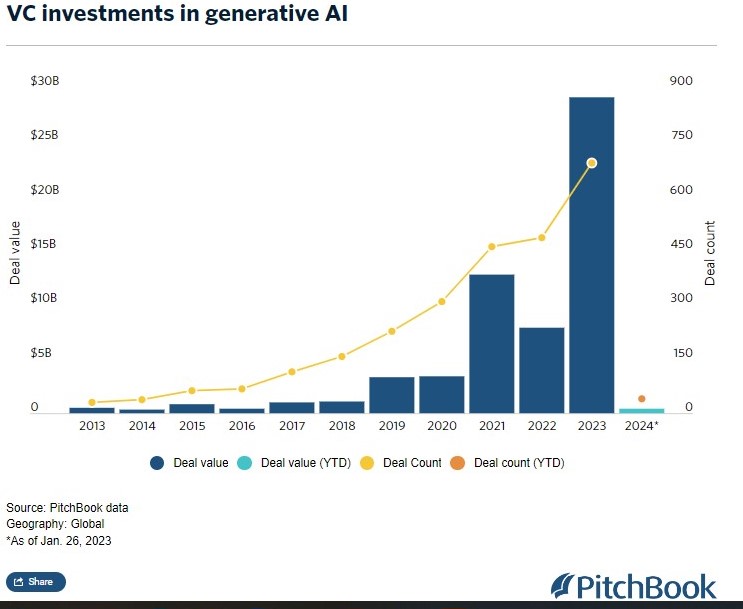

In this GenAI boom, much like the booms that came before it, Venture Capital has an outsized influence on the investment in the sector. Figure 6 shows that VC made a massive surge in investment in 2023 in GenAI, which the other investors emulated.

Figure 6. VC Investments in GenAI Rocketed in 2023.

GenAI valuations are Over the Moon.

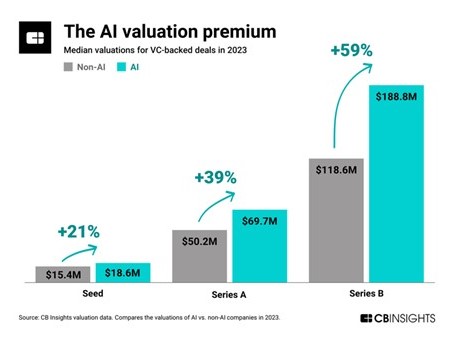

Not surprisingly, this explosion of funding has pushed the valuation of AI companies much higher than in other sectors. Figure 7 shows that the comparative valuations of AI companies exceed those of other tech companies by a margin which grows wider as the size of the company increases.

Figure 7. AI Companies Command a Premium Valuation.

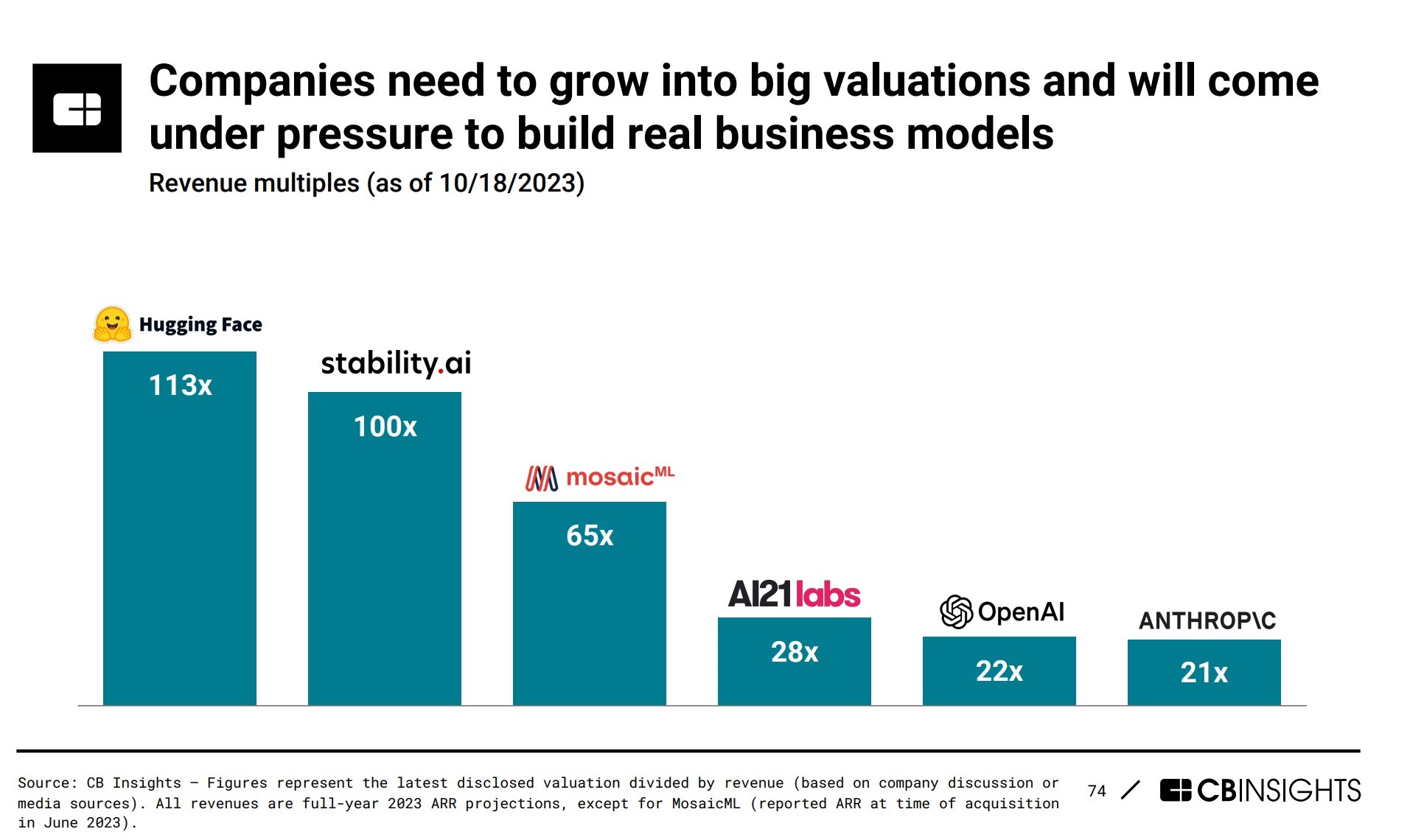

Figure 8 shows that the revenue multiples for some established GenAI companies range from 20x to 113x. Note that the younger companies Hugging Face and stability.ai achieve much higher multiples than the more established companies OpenAI and Anthrop\c.

Figure 8. AI Companies with Traction Achieve Huge Valuations.

To conclude, GenAI investors are investing huge sums at extraordinary valuations in a nascent industry.

Big Tech is All-in on GenAI

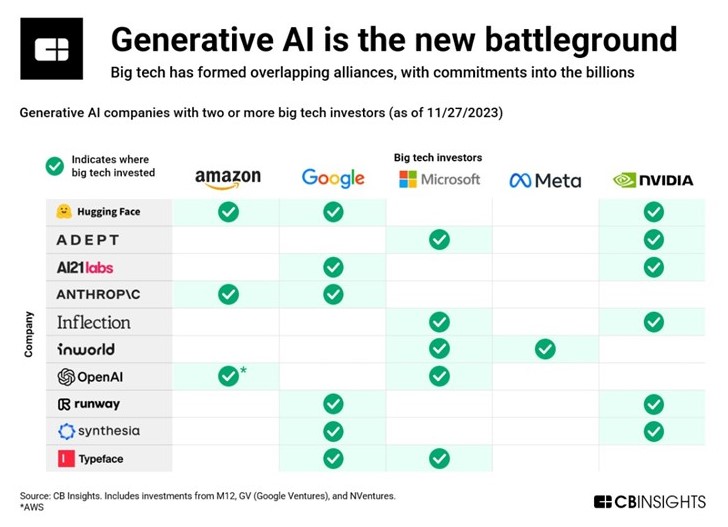

While GenAI startups are attracting VC funding, the large tech companies are also very active. They are investing billions in new companies and negotiating development partnerships with each other. Figure 9 shows the mosaic of companies and partnerships.

Figure 9. Big Tech Partnerships in GenAI.

The interesting revelation in Figure 9 is how cross-linked the partnerships are: each GenAI company, including most of the early-stage companies in Figure 8, have alliances with one or more of the Big Tech companies, and each Big Tech company has made multiple partnerships. With these overlapping interests, the GenAI industry players are co-operating as much as they are competing. This structure resembles the US semi-conductor in its early days in the 1960-70s.

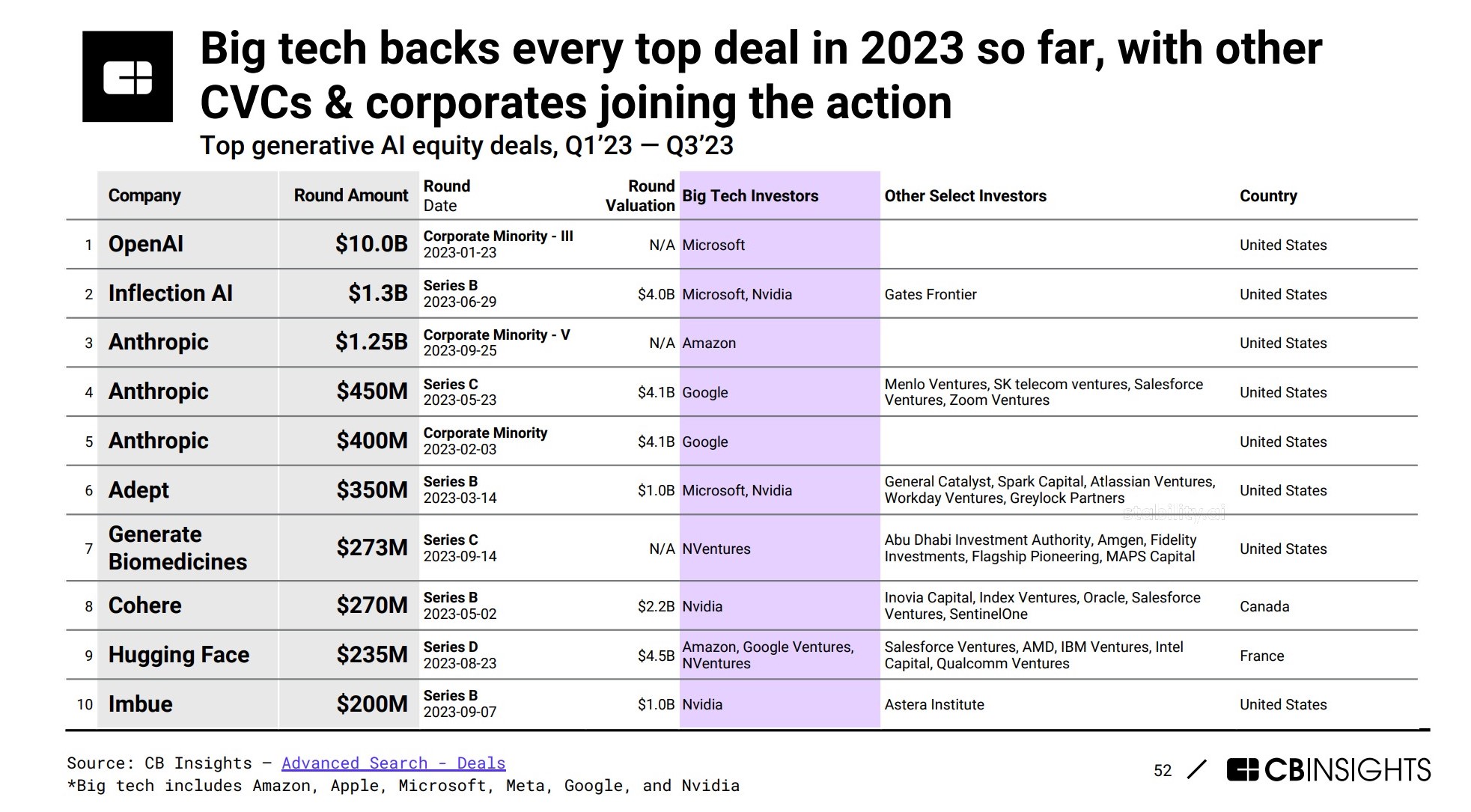

Figure 10 lists the big investments in GenAI in 2023.

Figure 10. Big Tech and VC Investments in GenAI in 2023.

As has been noted above, Microsoft placed the biggest bet with a $10B investment in OpenAI. Most deals are syndicated among several Venture Capitalists, Big Tech companies and Corporate Venture Capital (CVC) arms.

The collaboration among big companies and VCs is driving valuations into the billions; staggering values for companies that were only started a few years ago. GenAI startups can source investment capital from a plethora of investors.

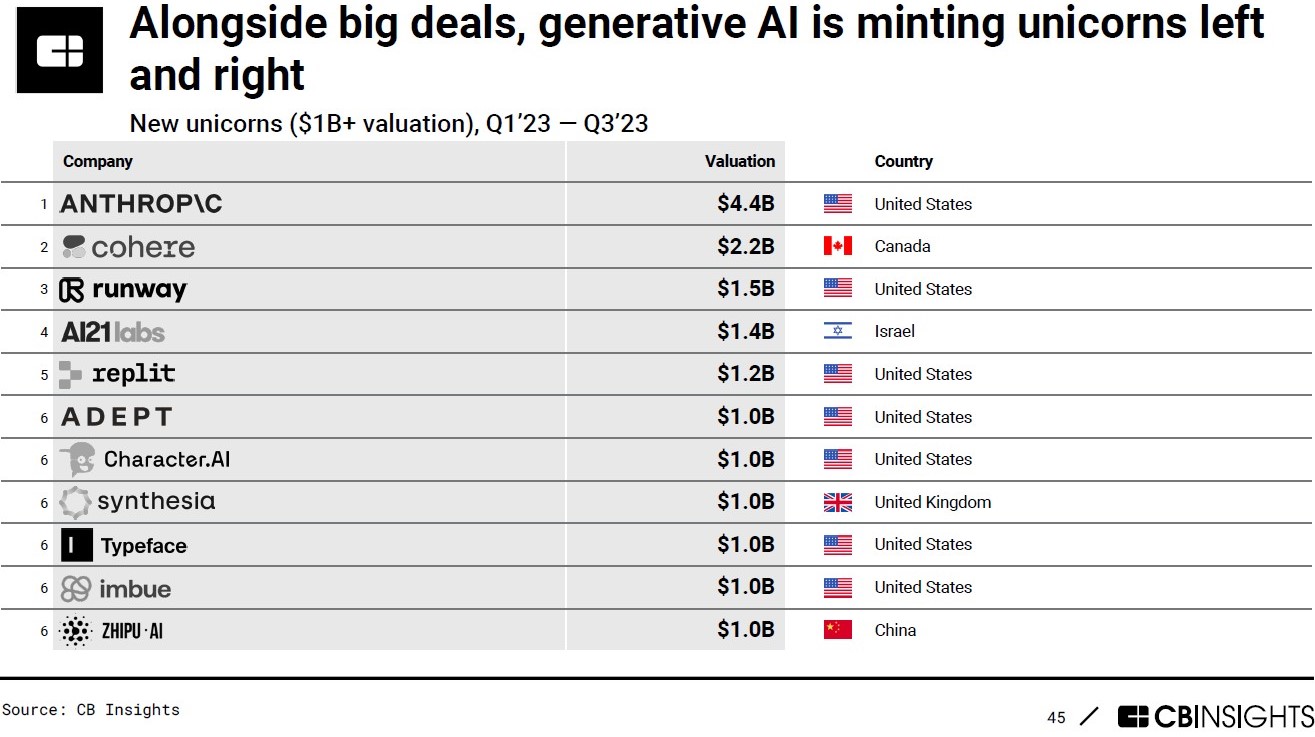

It is not surprising that with 20 mega-deals over $100M in 2023, and the stratospheric valuations, GenAI created 22 new unicorns. Figure 11 shows the ones created in Q1 to Q3.

Figure 11. GenAI is Creating Many Unicorns.

Where is the Money Going?

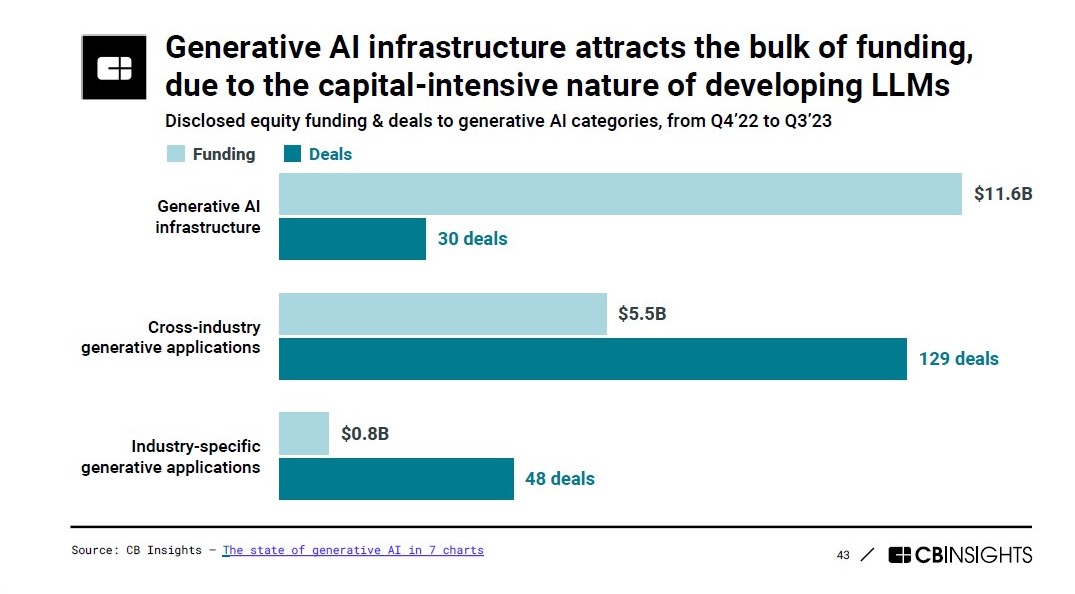

The new GenAI applications, like chatbots, are built on top of a huge infrastructure. Large Language Models (LLM) are trained on vast quantities of data which the bots search and reference to create new content. ChatGPT-4 was estimated to review over 1.76 trillion parameters in building its LLM, a significant fraction of the entire internet. It is very costly to build the infrastructure to train LLMs. In addition, there are two types of applications to develop; horizontal, or cross-industry, and industry-specific.

Figure 12 shows that most of the money is invested in infrastructure rather than applications at this early stage.

Figure 12. $12 Billion Invested, Mostly into Developing LLMs

As the use of GenAI grows, billions more will be invested in infrastructure and applications. This may be driving the collaboration among the Big Tech players, the new GenAI companies and investors, and large companies in industries incorporating GenAI into their business operations.

Partnerships and Strategy Maps

Figures 9 and 10 show that Big Tech is investing in leading-edge GenAI applications and infrastructure in collaboration with each other. That is just the starting point. Their investments do not stop at GenAI companies. They are only components of larger strategies to partner, invest or acquire GenAI technologies to extend their spheres of competence.

The adoption of GenAI is quickly spreading outside the tech industry. CBInsights has developed strategy maps which display the partnerships and investments for enterprise companies in Fintech, Healthcare and Industrials, as well as Technology. Figures 13 and 14 display the strategies fortwo of the Big Tech companies, Microsoft and Invidia. Figures 15 and 16 show the strategy maps for Bosch, and industrial company and Medtronic, a leading medical devices company.

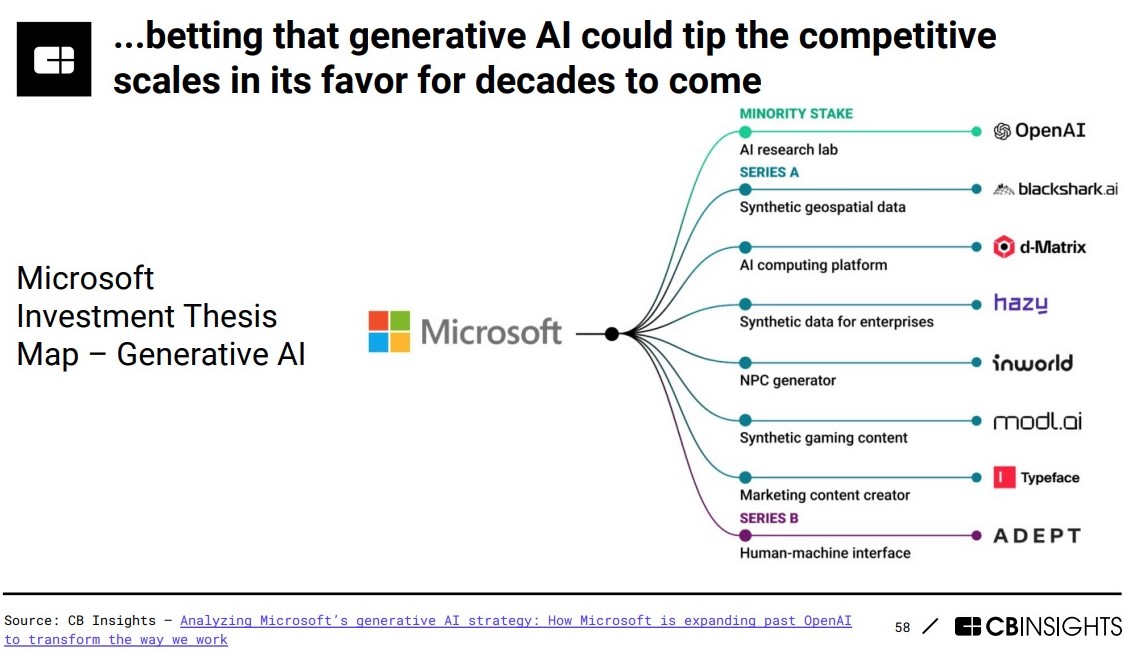

Figure 13 shows Microsoft’s strategy. It is making investments and negotiating partnerships with companies across the waterfront of GenAI activity.

Figure 13. Microsoft GenAI Strategy.

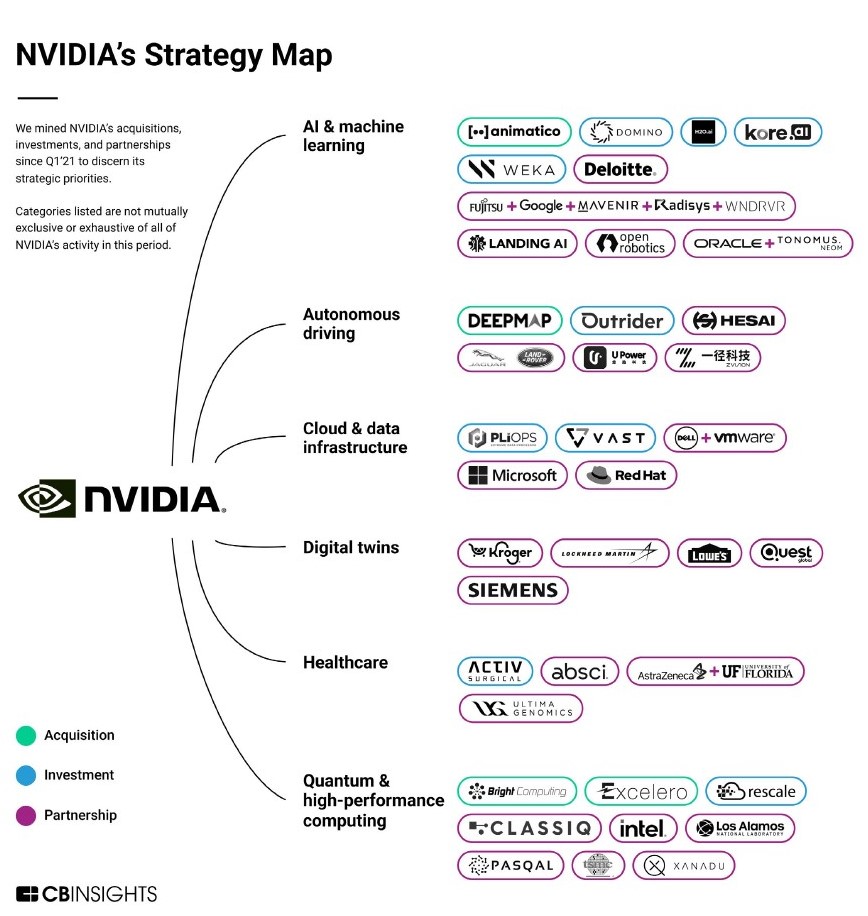

Nvidia has made investments in many AI sectors and companies as depicted in Figure 14. Its stock price has increased 24-fold since 2020 and the company recently achieved a valuation exceeding $2 trillion.

Figure 14. Nvidia Strategy Map

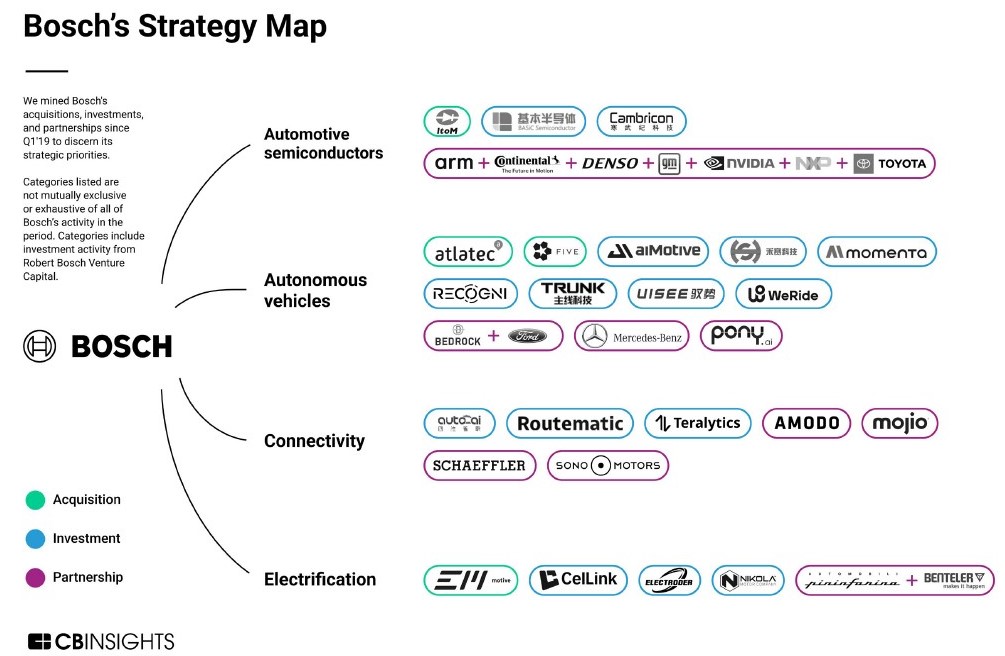

Figure 15 shows the strategy map for Bosch. Better known for its automotive components and power tools, Bosch is now riding the wave to automotive AI.

Figure 15. Bosch Strategy Map

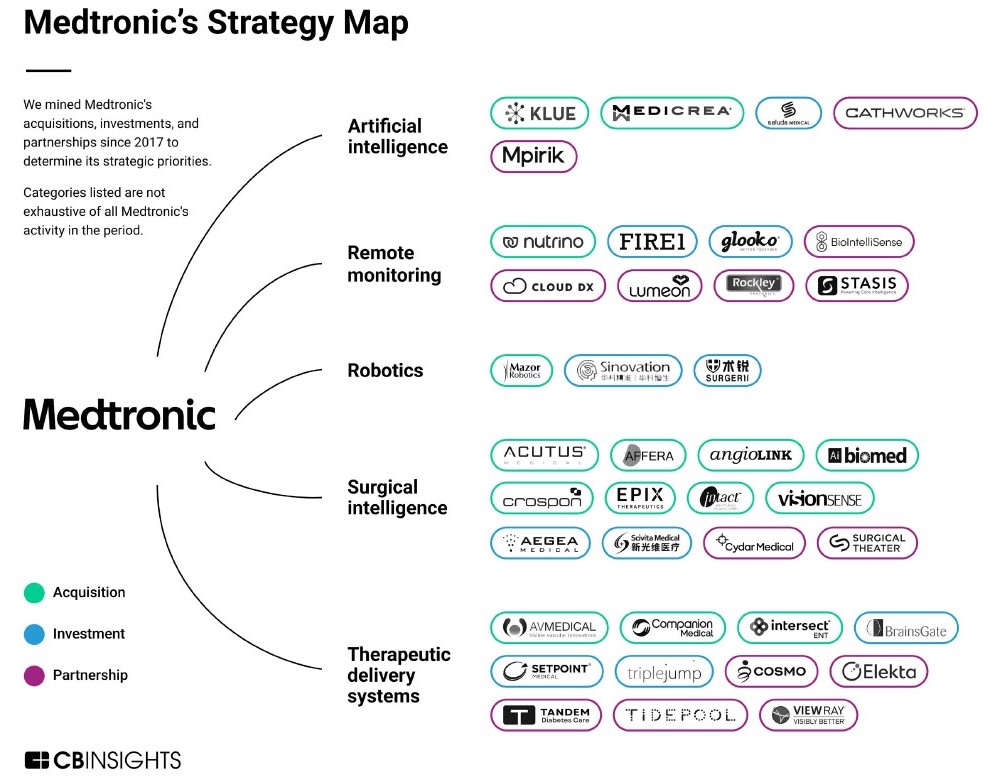

Medtronic is one of the largest healthcare technology companies in the world. It is introducing AI into many of its services as shown in Figure 16.

Figure 16. Medtronic Strategy Map.

Conclusion

GenAI is penetrating the world economy faster than any previous technology. The adoption rate of GenAI applications is the fastest in history by orders of magnitude. Hundreds of companies are being formed overnight.

Big Tech is making billion-dollar investments in GenAI in partnerships with VCs and CVCs. Valuations are in the billions for some companies only a few years old.

Venture Capital firms have invested billions so far in GenAI and there are trillions more to invest in an exciting new industry.

Although the rest of the tech sector is still in the doldrums after the crash in 2022, the GenAI sector is attracting interest and investment.

Companies in other industries are quickly incorporating GenAI technology into their operations and developing partnerships with GenAI companies. Major components of their strategy include partnering, investing, and acquiring early-stage GenAI companies. As the GenAI industry follows traditional paths, there will be consolidation of companies and a narrowing of the technology and markets. GenAI companies and their potential partners need to adapt their strategies to optimize their returns.