Global Robotics Investments: Seven Year Trends

Angel and institutional investments made in robotic companies over the past seven years are slowly shifting from startup to scaling companies, according to research conducted by Vancouver-based boutique technology M&A advisors, Strategic Exits Partners.

Last year, we published our research on robotics acquisitions: “Is America Catching up in the Global Robotics Race?”, specifically targeting M&A activity in the robotics industry. The study concluded the US was leading in acquiring technologies in the emerging field of robot mobility, not in traditional industrial robotics.

We recently compared the trends in robotics investments in 2022 to the period of 2016 to 2021 (data powered by CrunchBase). These have been perilous times: a war, sudden reappearance of inflation, rapidly rising interest rates and a major stock market correction. Given these events, one may wonder if the investment in robotics has slowed down, or maintained its pace?

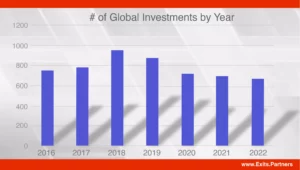

So, we analyzed 5000 global investments made over the past seven years, eliminating 20 public transactions that would skew the numbers and were not relevant to emerging companies’ strategy. As can be seen, the global number of investments in 2022 was, although slightly trending down, approximately at the same levels as in 2020 and 2021 during the COVID pandemic.

While not as high as 2018 in the heyday of robotics investments, the number of investments remained somewhat steady in 2020-2022.

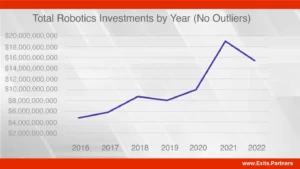

When we examine the financial value of these investments, we see interesting trends. Whereas the number of investments was relatively the same in 2020-2022, the total value of those investments was significantly higher in that period, especially when compared to the period of 2016-2019. Even with the reduction of investments in 2022, that year still posted the second-highest amount invested over the last seven years.

So, the decline in robotics investments in 2022 must be viewed in the context of the investments in 2016–2022. It is clear that COVID events did not affect robotics as the investments grew substantially overall in that period. Although the number of deals has declined from the peak in 2018, it appears that the deal $ size is increasing.

One would expect that the cohort of robotic companies founded in 2016 – 2020 would be receiving large expansion capital by 2020 to 2022, yet it appears that investors are favouring emerging companies. Perhaps startups and scaleups are still proving out their technologies to their customers and are not ready to scale up to address global markets.

Local examples of a companies that have promising robotic technologies and are considered emerging or growing rapidly , are Apera AI, specializing in 4D robotic automation, enabling bin picking, packaging and assembly to work faster and more precisely; and, Sanctuary AI, whose mission is to create human-life intelligence in general purpose robots. Nexera Robotics, has developed a gripping technology enabling stationary robots to easily grasp and manipulate objects for commercial applications.

Another example is Vancouver’s Human in Motion Robotics which recently announced a $10 million Series A financing round with an $8 million investment and strategic partnership with Beno Holdings, a prominent Korean firm focused on technology investments. This financing reinforces the recent trend of North America taking the lead in the new frontiers of robotics: mobility.

Historically the US and Canada have lagged in robotic systems for industrial applications. This has now changed with innovation in robots that move around humans (for example, robots in warehouses now augment or replicate human motion). Recently, local announcements from Sanctuary AI and Elon Musk’s Optimus Tesla Bot add to the momentum.

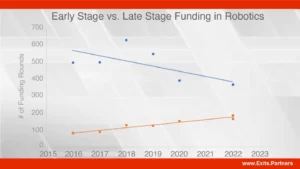

We also examined the timing of investments with respect to robotics company growth. The vast amount of funding is still at Seed and Series A. Again, however, this analysis must be placed in the context of the trends over the period from 2016 – 2022. In the graph below, early-stage funding (up to and including Series A) is slowing down (blue line) while later-stage (post Series A) funding (orange line) is increasing.

The diagram depicts the number of funding rounds since 2016. The upper slope tracks early stage and the lower slope large institutional investments. Although most funding rounds are still for emerging companies, the trends since 2016 are clearly down for emerging companies and up for established companies suggesting that investors are narrowing their scope. Overall, the trend appears to be marginally towards fewer, larger investments, particularly since 2020.

In another analysis we conducted, this point is reinforced when comparing the amount of Seed funding to that of Series A. The quantum of Seed funding is 1.5 times that of Series A.

Within the next two or three years, seed companies will arrive at the decision point where they either have to access institutional funding in order to scale, or to sell their company. This critical and binary decision point is driven by the founders’ personal drivers and the structural situation of the startup or scale up: i.e. where it is in the technology stack and the nature of the commercialization scaling challenge.

Strategic Exits Partners is continuing to assess the trends in the automation industry and the implications to exit strategies. Stayed tuned for our next article which will examine China’s role in robotics.